Summary - Yesterday, the market made a large liquidation move lower. Today, while the liquidation continued, price was able to hold at value...

Top View Look

Bearish signals are apparent inspecting the negative slope of the On Balance Volume trend

After yesterday’s liquidation the NQ price has clearly been accepted into it’s 90 Day HVA/POC while the ES has slipped below its SMA200 where it building additional support would seem reasonable. Lower volume today suggests balancing (high volume would suggest panic, right?)

One interesting observation is that if we hang here long enough, we may have a chance to hit a major trend line and get to see what happens.

| ES Liquidation Pausing on lower volume beneath SMA 200 - Either balancing or catching breath.... |

| NQ at 90 day POC. |

Market Profile View:

Summary - Tuesday's price was respected Monday's lows and the Globex levels for highs.

The NQ has trended lower for two consecutive days. Wednesday’s Low of Day matched that from yesterday coinciding with a noticeable LVP in the composite. Wednesday’s price attempted to go higher upon release of the FOMC minutes but did not get past globex high nor the anomaly from yesterday.

If the NQ breaks lower, targets include the LVA south of the composite twin peaks. If the high volume price at 4772 fails to hold lower, the MP & Pivots will be examined for further liquidation points. Otherwise, the NQ appears to find the 90 day POC as support.

| NQ support at 90 Day POC. Possible LVA targets below. |

The ES MP shows price did not match yesterday’s low. As mentioned before, yesterday’s low is important because that level goes back the BREXIT time period and any lower would require pulling out older MP charts for reference.

However, that might be what the market is needing to do (revisit BREXIT levels) that weren’t fully addressed during Z16 rollover? Because of the negative OBV trend line, continue to watch for lower target levels.

| ES Did not exhibit panic liquidation today. Watch for retesting for further liquidation & expecting LVA filling. |

VOLUME:

ES DAILY VOLUME: 88% of average and less than yesterday

NQ DAILY VOLUME: 112% of average and less than yesterday

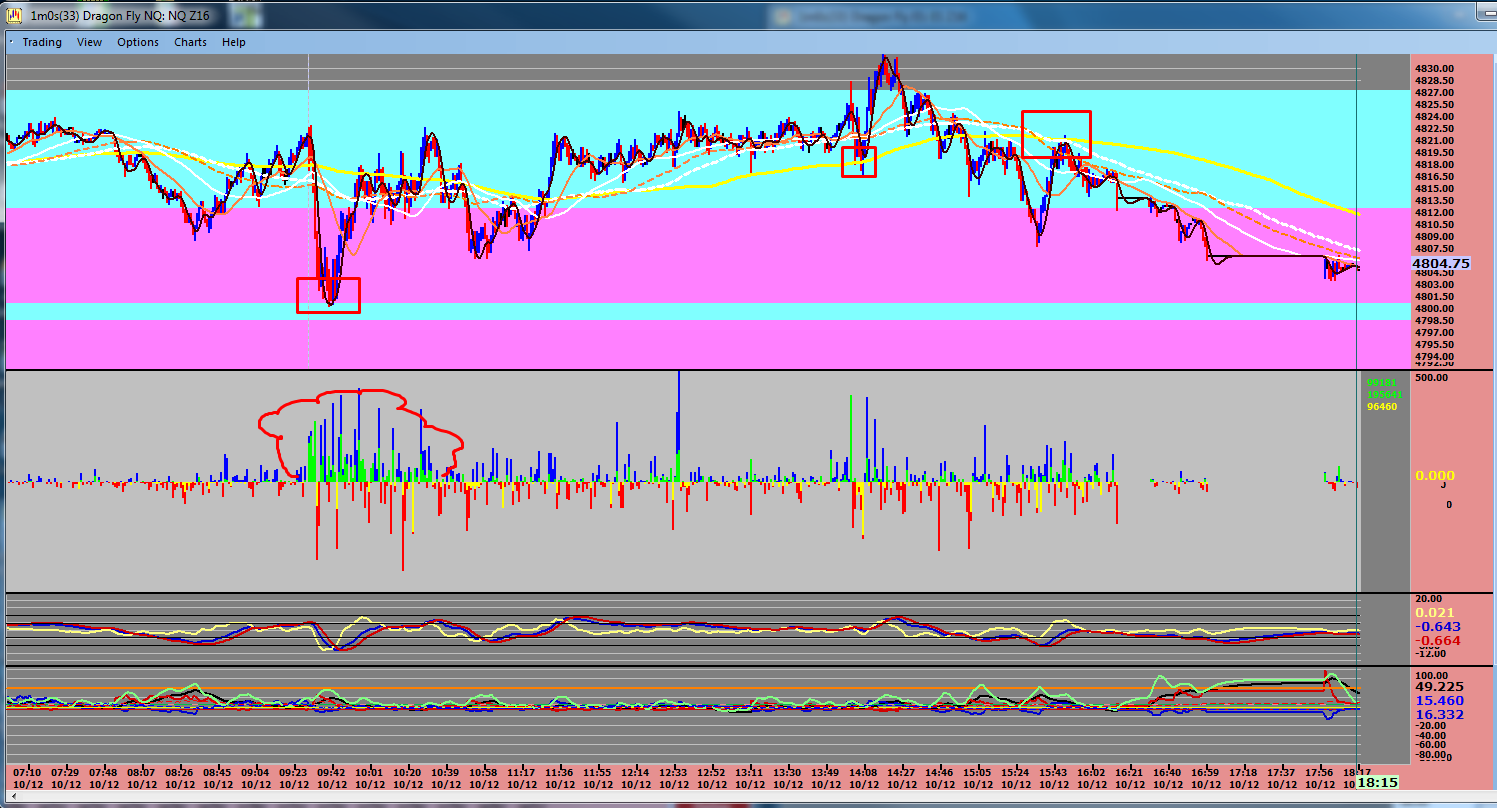

The ES shows fewer large lot traders throughout the day than yesterday. This view also shows two ideal SMA bounce entries. We can see the abundance of residual sell orders resulting from yesterday's action appear in the morning session. However, the HVA at 2127 did a very good job. The mid day rally campaign coincided with the release of the FOMC minutes. In the the afternoon, liquidation occurred (again, stopping at the LOD) (WATCH FOR SELLING IN TOMORROW'S OPENING).

| ES with Large Trader Filtering showing support at 2127 and slight selling tail at 14:30 |

The large lot traders were very apparent supporting price at the morning's low of day when residual sell orders opened the day. Despite bringing price up midday, the afternoon was spent liquidating. (LOOK FOR SHORTS IN THE MORNING OPENING TOMORROW)

VOLUME Continued - Despite today's settlement price being relatively close to yesterday's settle, the OBV shows lots of liquidation took place today.

| Liquidation Day - Especially at cash closeout |

Other - Pivot points appeared relevant for the High of Day. All other pivot points too far out of range. Short time frame traders were in control today with respect for visual support/resistance levels. Today’s flow was very choppy (is this indicative of being in a “fresh trading range”?)

If I Were Big Money:

The negative trend on the OBV says continue a controlled liquidation holding value up as high as possible. Unfortunately, that would mean the retail traders and dealers are holding.

If I were big money, and couldn't maintain a balance here, a retreat back to contract lows come to mind. Perhaps a revisit to the contract low is in the future anyway?

Otherwise, if I were Big Money, I would also continue to try to hold a balance at these levels through the elections because those could be my orders....

If I were Big Money, I made my major move yesterday, continue my liquidation at these levels today, and will let the short time frame traders work it around here awhile -- Unless something happens.

No comments:

Post a Comment