This came out at 7:46 am

Backdrop: LMT Price had recently double topped off the $270 target and was already in the process of correcting when the tweet came out making news. This double top capped of a very nice post election rally plus surprise word that future growth at 7% was possible. "Buy on the rumor and sell the news...." Remember that one?

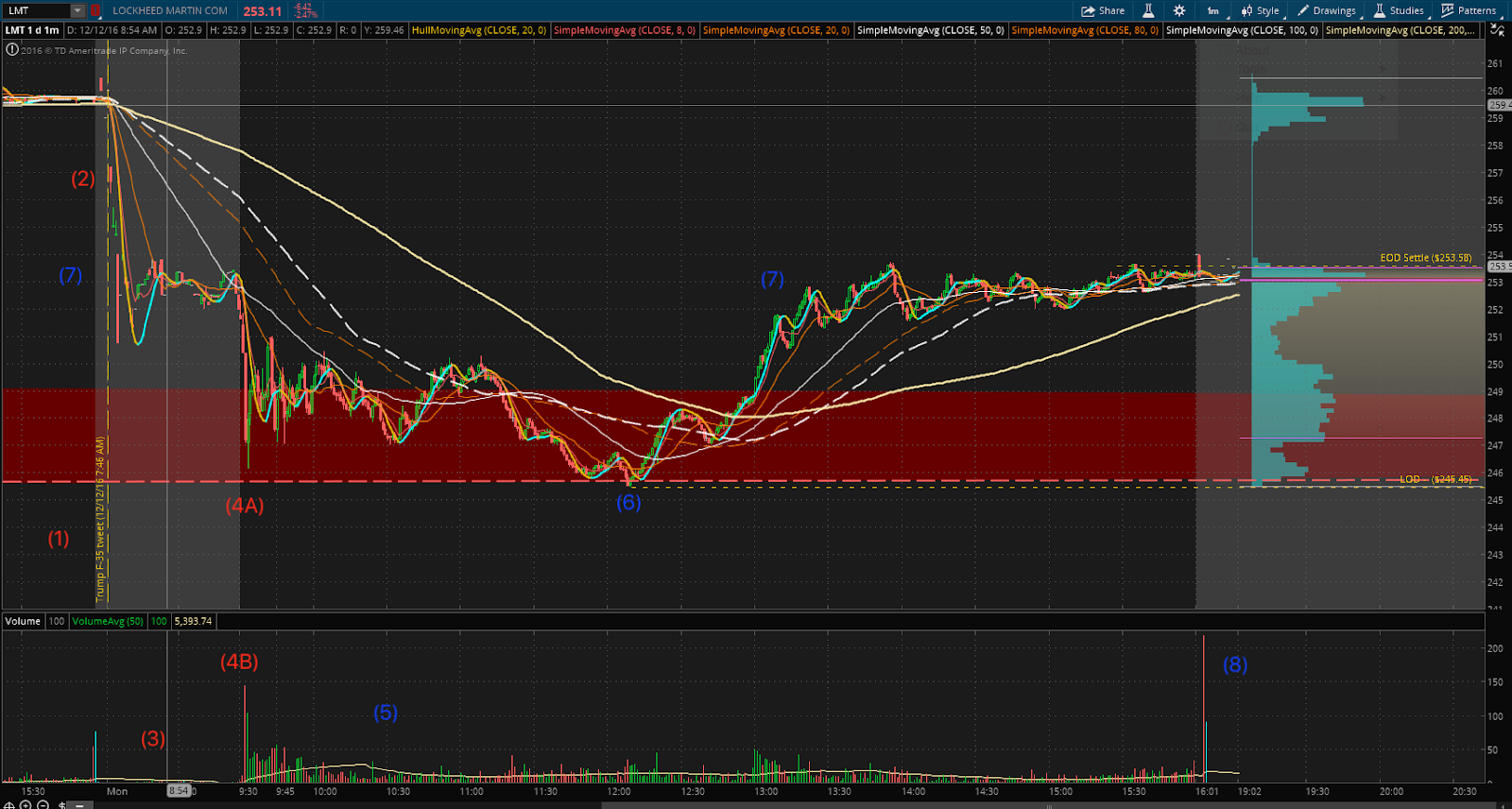

Summary: After the news making tweet, an orderly sequence of activity took place, demonstrating the strength and depth of the market as well as the market's ability to make a profit trading under the guise of "the news".

A One Year view is provided to aid in gathering context. Notice the major trend channel forming. Remember this

|

| One Year View |

A closer view at 90 days out shows price putting in a double top at the $270 target level and catching support off the SMA 200, putting in a low of the day close to the reach of the lower major trend line (red). Only short timeframe traders can execute this so exactly.

|

| 90 day view |

Zooming in to the Daily View, here is today's DETAILED PRICE ACTION:

|

-

PRICES CRASHES ON PRACTICALLY….

-

A & B - “SELL ON OPEN” ORDERS FIRE OFF AT THE OPENING BELL WITH RESPECTABLE VOLUME, SELLS INTO...

STRONG STEADY BUYING (ACCUMULATION) AT THE DISCOUNT

PRICE TESTS MAJOR TREND LINE

AND PROCEEDS TO MARKUP PRICE TO THE PREMARKET POINT OF CONTROL UNTIL

CLOSING BELL, END OF SESSION WHEN THE CASH OUT IS ALL THOSE HOLDING LONG WHO MADE A NICE PROFIT BUYING AT THE DISCOUNT.

|

TAKEAWAY:

RULING REASON: LONG TERM TRADERS ENDED THE DAY WITH A -2.4% CHANGE ON AN ISSUE THAT WAS APPEARING READY FOR A CORRECTION.

RULING REASON: THE QUICK AND NIMBLE DEALERS APPEARED TO HAVE PROFITED NICELY DRIVING THE MARKET DOWN ON NEWS AND LITTLE VOLUME, WITH LAGGARD SELLERS ARRIVING AT THE OPENING BELL, AND THE BOUGHT LOW WHILE SELLING HIGHER. PRETTY SLICK....

RULING REASON: THIS WAS A COORDINATED MOVE IN RESPONSE TO NEWS. WATCH FOR THIS IF TRUMP TWEETS OTHER COMPANIES

RULING REASON: TOMORROW AND IN THE DAYS AHEAD, WATCH FOR THE ARRIVAL OF LARGE LOT TRADERS (LONG TIMEFRAME TRADERS) TO PARTICIPATE IN THE NEWS.

PUT THESE 9 ON YOUR WATCHLIST....

http://www.cbsnews.com/media/9-ceos-who-may-fear-a-donald-trump-presidency/

AMAZON

FORD

APPLE

LOCKHEED MARTIN

NEW YORK TIMES

FACEBOOK

H&R BLOCK

PFIZER

BLACKSTONE